“I want to know how to prevent credit master attacks.”

“What kind of damage is caused by credit master attacks?”

The number of e-commerce businesses that feel threatened by credit master attacks, which are frequently heard about these days, has increased.

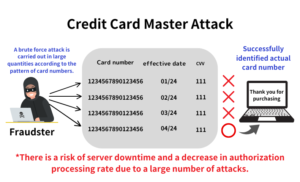

Credit master is a criminal act of fraudulently using someone else’s credit card by taking advantage of the regularity of card numbers.

When a large number of credit master attacks occur, a large number of authorizations are generated, which can lead to a heavy burden of payment processing fees and a strain on servers, negatively affecting payment processing.

This article will explain:

- Damage caused by a large number of credit master attacks

- Measures to prevent damage from credit master attacks

EC operators will be able to see what they should do to prevent unauthorized use by credit masters by reading this article.

目次

- 1 The Damage From Credit Master Continues To Break New Records in Japan

- 2 Four Types of Damage Incurred by E-commerce Businesses Due to Credit Master Fraud

- 3 Four measures to prevent damage from credit master fraud

- 4 If you’re looking for credit master countermeasures, we recommend the fraudulent order detection system “O-PLUX”.

- 5 Summary

The Damage From Credit Master Continues To Break New Records in Japan

First, let’s look at the amount of damage caused by credit master fraud.

The amount of damage caused by credit master fraud is currently at a record high and continues to increase, making it no exaggeration to say that it is a serious social problem.

As you can see from the red box in the graph below, the amount of damage from card number misuse is increasing year by year, with 37.63 billion yen in damage occurring between January and September 2023.

※引用:日本クレジット協会

Since credit card fraud due to number theft is expected to continue in the future, EC businesses should urgently implement measures against fraud.

Moreover, credit card fraud is carried out using various methods other than number theft, so it will be necessary to implement measures that can deal with various methods.

Four Types of Damage Incurred by E-commerce Businesses Due to Credit Master Fraud

Here, we will introduce the damages that e-commerce businesses suffer due to large-scale credit master attacks.

There are four types of damages that e-commerce businesses suffer due to large-scale credit master attacks.

- Increased burden due to a large number of authorizations

- Becoming a target for criminal groups

- Server downtime due to large-scale attacks

- Loss of customer trust

We will explain each of these in detail.

When an EC business suffers credit master fraud, a large number of authorizations occur, increasing the burden on the EC business.

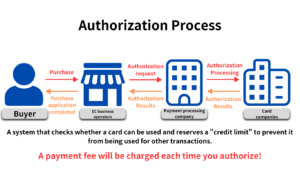

Authorization is the procedure of automatically confirming credit information with the credit card company when a customer uses card payment.

Authorization requires e-commerce businesses to pay a processing fee, so a large volume of authorizations increases the burden of these fees.

2. Targeted by criminal groups

If an unauthorized credit card transaction occurs, your site is more likely to be recognized by criminal groups as having “lax security measures.”

Once a criminal group targets your site, you could experience thousands or tens of thousands of unauthorized access attempts, potentially leading to further fraudulent activity.

3. Servers crash due to mass attacks

If credit card mastering attempts are made in large numbers, the server may crash due to the load.

A server crash can lead to a loss of sales opportunities from legitimate customers, which can cause significant losses for e-commerce businesses.

In addition, recovery work takes time and effort, which not only reduces operational efficiency but also incurs unnecessary labor costs.

4. Loss of customer trust

If an e-commerce site becomes known for being a victim of credit card fraud, customers may think, “I don’t want to buy from a site with weak security measures.“

Also, a large-scale credit card fraud attack can cause the server to crash, leading to customers thinking, “This is a disappointing store where I can’t buy what I want when I want it,” which can lead to a loss of trust.

Trust issues significantly impact sales, so be sure to implement credit card fraud countermeasures to avoid losing trust.

Four measures to prevent damage from credit master fraud

In the previous chapter, we explained that the damage caused by credit master is significant, so from here we will introduce countermeasures to prevent damage.

There are four measures to prevent damage from credit master.

- Set input restrictions

- Introduce reCAPTCHA

- Introduce 3D Secure (personal authentication service)

- Introduce a fraudulent order detection system

We will explain each in detail.

[Measure 1] Set input limits

By setting input restrictions, you can prevent mass attacks by credit masters.

Credit master is an act of illegally using a large number of card numbers that can be conceived based on regularity by entering them into a form, so setting input restrictions can be said to be an effective measure.

However, it also blocks legitimate users who make continuous input errors, which carries the risk of “cart abandonment,” where they stop the purchase process midway.

[Measure 2] Introduce reCAPTCHA

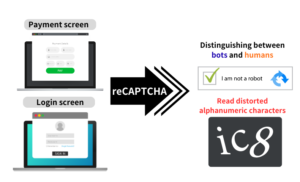

By implementing reCAPTCHA, you can take measures against malicious bots.

bot: A program that automatically executes predefined processes.

reCAPTCHA is a security tool that distinguishes between bots and humans by asking users to check a box that says “I am not a robot” or by having them read distorted alphanumeric characters.

While implementing reCAPTCHA is effective for bot countermeasures, there is a risk that it can be bypassed if credit card fraud is carried out manually.

[Measure 3] Introduce 3D Secure (identity verification service)

One effective measure against credit master fraud is the introduction of 3D Secure (personal authentication service).

3D Secure is a system that authenticates high-risk transactions, such as with one-time passwords, when making payments for online shopping.

By performing personal authentication only for high-risk transactions, it can be said that credit master fraud countermeasures can be taken while suppressing the risk of “cart abandonment”.

Furthermore, the Credit Card Security Guidelines require all merchants in principle to introduce 3D Secure by the end of March 2025 in Japan.

However, 3D Secure alone is not a perfect countermeasure against credit master fraud. It can be said that comprehensive measures can be taken by using 3D Secure in conjunction with a fraudulent order detection system.

[Measure 4] Implement a fraudulent order detection system

To prevent credit master fraud, we recommend introducing a fraudulent order detection system that discovers and blocks fraudulent acts by humans, in addition to bot countermeasures and 3D Secure.

A fraudulent order detection system is a system that detects fraudulent purchases at the time of order and stops product provision before shipping.

Cacco Inc., which operates this site, develops and provides fraudulent order detection systems such as “O-PLUX” and “Fraud Checker.”

As mentioned earlier, reCAPTCHA and 3D Secure alone cannot completely block credit master fraud carried out by human hands.

Therefore, to block both bot and human-operated fraudulent activities, it is necessary to introduce a fraudulent order detection system, which can be said to be the strongest countermeasure against credit master fraud.

If you’re looking for credit master countermeasures, we recommend the fraudulent order detection system “O-PLUX”.

If you’re looking for a fraud detection system to counter credit master fraud, “O-PLUX” is highly recommended.

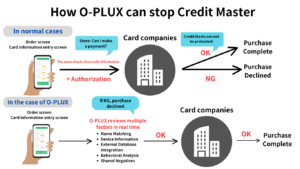

The reason O-PLUX can stop credit master fraud is that it conducts real-time screening using multiple factors such as device information and attribute information before authorization on order screens and card information registration screens, preventing suspicious credit master payments from proceeding to authorization.

In this way, O-PLUX can make highly accurate and instantaneous judgments because it analyzes multiple elements in real time to detect suspicious points in orders.

Summary

You now understand that credit master attacks don’t just affect cardholders, but also cause significant damage to e-commerce businesses.

There are four types of damage that e-commerce businesses suffer due to credit master attacks:

- Increased burden due to a large number of authorizations

- Becoming a target for criminal groups

- Server downtime due to mass attacks

- Loss of customer trust

In the worst-case scenario, it could seriously damage the continuation of EC site operations, so it is important to take credit master countermeasures as soon as possible.

There are four countermeasures to prevent damage from credit master attacks:

- Set input restrictions

- Introduce reCAPTCHA

- Introduce 3D Secure (personal authentication service)

- Introduce a fraudulent order detection system

To prevent fraudulent activities from both bots and human hands, we recommend introducing a fraudulent order detection system.

Among fraudulent order detection systems, consider introducing “O-PLUX” or “Fraud Checker,” which offer the strongest high-precision detection in Japan.