Chargeback refers to a system where credit card companies cancel transactions that the cardholder did not authorize and refund the money to the cardholder.

While this system provides security for cardholders, in recent years there has been an increase in cases where this system is exploited to defraud merchants by obtaining goods without paying for them.

As a result, e-commerce businesses may not only have to refund the payment but also not get the product back. Failing to take measures against chargebacks (damage from credit card fraud) can have a serious impact on their business.

This article explains:

- An overview and mechanism of chargebacks

- Causes of chargebacks

- Impact and risks of fraudulent chargebacks on businesses

- Methods to prevent chargebacks in advance

目次

- 1 What is a Chargeback?

- 2 3 Causes of Chargebacks

- 3 Three Impacts of Chargebacks on Businesses

- 4 Four Measures Businesses Can Take to Prevent Fraudulent Chargebacks

- 5 [Supplemental Information] Authorization does not prevent chargebacks

- 6 Q&A about Chargebacks [For Businesses]

- 7 Summary: Businesses should take measures against fraudulent use before chargebacks occur

What is a Chargeback?

A chargeback is a system where a credit card company cancels a sale and refunds the cardholder if the cardholder does not consent to a payment made with their credit card.

In Indonesia, the rate of chargeback occurrences remains low, but it is expected to increase in proportion to the growing use of credit cards.

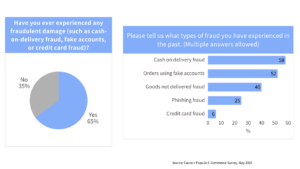

In Japan, credit card chargebacks are the most common type of fraud in e-commerce.

Next, we will explain the overview and mechanism of “chargeback,” which protects users from credit card fraud.

Chargeback Process

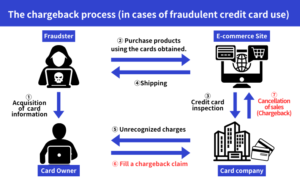

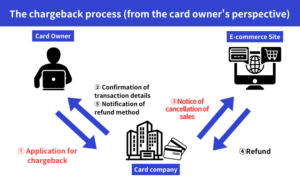

Chargebacks play a role in protecting cardholders from credit card fraud. When a chargeback is utilized, the credit card company can cancel a sale if a cardholder-unapproved payment (e.g., fraudulent use) occurs.

From a business perspective, sales are lost, and the product ends up with the fraudulent party.

Below is a diagram of a chargeback when a credit card is used fraudulently.

The number of chargebacks is on the rise, and it wouldn’t be surprising if they negatively impacted your company’s performance at any time.

It is crucial for businesses to fully understand the risks companies face and the measures they can take to prevent chargeback fraud.

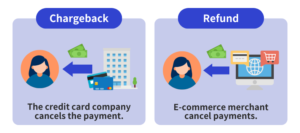

Differences Between Chargebacks and Refunds

The difference between a chargeback and a refund depends on whether the credit card company or the merchant cancels the payment.

Chargebacks occur when the credit card company cancels a payment, while refunds occur when the merchant cancels a payment.

In both cases, the sales amount is returned to the credit card holder (customer), but chargebacks place a greater burden on the merchant compared to refunds.

For more information on the impact of chargebacks on businesses, please refer to “3. Three Impacts of Chargebacks on Businesses.”

Chargebacks are increasing.

In recent years, there has been an increase in fraudulent chargebacks where individuals receive goods without payment, causing businesses to lose sales.

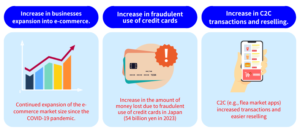

The main reasons for the increase in chargeback cases are the following three:

- An increase in businesses expanding into e-commerce due to the COVID-19 pandemic

- An increase in credit card fraud

- An increase in C2C transactions and reselling in the e-commerce market

The e-commerce market continues to expand in the wake of the COVID-19 pandemic, and credit card fraud is increasing as a result.

▼ What is “credit card number theft”?

Unauthorized settlement using only credit card information, without the theft, counterfeiting, or alteration of the card itself.

Fraudsters profit by fraudulently using credit cards to purchase goods and then reselling them.

In other words, the increase in CtoC transactions (flea market apps, online auctions) can also be cited as a reason for the increase in chargebacks.

As the e-commerce (online shopping) market expands, so does the fraudulent use of credit cards, leading to an increase in chargeback cases. Therefore, it is important to understand the causes of chargebacks (credit card fraud) and implement countermeasures.

3 Causes of Chargebacks

Chargebacks often occur due to credit card fraud, which is on the rise and becoming increasingly sophisticated, requiring vigilance.

There are three main reasons for chargebacks, in addition to credit card fraud:

- Credit card fraud

- Merchant error

- Friendly fraud

We will explain each of these in detail, so please refer to them.

[Cause 1] Credit card fraud

The first cause is unauthorized credit card use.

As mentioned earlier, unauthorized credit card use is increasing year by year, and it is the most common cause of chargebacks.

Examples of credit card fraud include:

- Theft or loss of a credit card

- Leakage of credit card numbers (phishing, skimming)

- Credit master attacks

Here’s a summary of each explanation below.

| Causes of fraudulent use | Tactics |

| Theft/loss of credit card | Loss or theft of the credit card itself |

| Credit card number leak (phishing) | Acts where malicious third parties fake websites or emails to illegally extract card information, etc. |

| Credit card number leakage (skimming) | The act of illegally stealing card information, etc., using special machinery. |

| Credit Master | The act of fraudulently using another person’s credit card by exploiting the regularity of card numbers. |

When credit card fraud occurs, a chargeback happens. Considering the cancellation of sales and the inability to recover goods, it can be said that businesses should immediately implement measures against chargebacks caused by credit card fraud.

For information on measures against chargebacks caused by credit card fraud, please refer to “5 Measures Businesses Can Take to Prevent Fraudulent Chargebacks” for details.

[Cause 2] Merchant-side errors

The second cause is a mistake on the part of the business owner.

Although this is not a case of fraud, it’s important to be aware that credit card refunds can be considered chargebacks.

Examples of chargebacks occurring due to merchant errors include:

- Shipping defective products

- Failing to ship products despite payment already being made

- Charging twice for the same purchase

To prevent chargebacks due to merchant errors, strengthening quality control and automating inventory and order management would be effective.

[Cause 3] Friendly Fraud

The third cause is friendly fraud.

Friendly fraud refers to the fraudulent act where an individual, despite having purchased a product with their credit card, contacts the card company claiming they “don’t remember making the purchase” to avoid paying for it.

Friendly fraud includes the following actions:

- Forgetting a purchase and mistakenly believing it to be an unauthorized charge

- Not understanding cancellation or return policies, missing the return period, but still wanting a refund

- A family member using the card without permission

- Understanding the chargeback system and requesting a refund after ordering a product

In some of these cases, there may be less malicious intent, but chargebacks can still be approved, so caution is necessary.

Just like the two causes mentioned above, in the case of friendly fraud, sales are canceled and the products are not returned.

To prevent chargebacks due to friendly fraud, it is effective to:

- Provide clear guidance on cancellations and returns

- Send order confirmation and delivery information emails to keep proof of purchase and delivery

- Add authentication to prevent unauthorized use of cards by individuals other than the cardholder

Additionally, if a chargeback occurs due to friendly fraud, you should dispute the chargeback.

For a detailed explanation on how to dispute chargebacks, please refer to “6.3 Can Chargebacks Be Rejected?“.

Three Impacts of Chargebacks on Businesses

When a chargeback occurs, not only is the sale reversed, but in many cases, the merchandise is not returned, resulting in significant losses for businesses.

Furthermore, the occurrence of chargebacks not only leads to a decrease in sales but can also damage credibility and negatively impact the continuity of the business if they happen frequently.

The following three points can be cited as concrete effects of chargebacks on businesses:

- Sales are cancelled, and products are not returned.

- A chargeback fee is incurred (approximately 1,300 yen per case).

- If the chargeback rate becomes high, businesses may lose credibility with credit card companies and be subject to penalties.

In this way, chargebacks pose a serious risk to businesses, so it is important to prevent fraudulent chargebacks from occurring.

Four Measures Businesses Can Take to Prevent Fraudulent Chargebacks

Improper chargebacks (credit card fraud) pose a significant risk to businesses.

Here are four specific measures businesses can take:

- Introduce card verification (security code).

- Implement EMV 3D Secure (3D Secure 2.0).

- Implement a fraud detection system.

- Join chargeback insurance.

All of these measures are important, so let’s examine them one by one.

[Countermeasure 1] Introduce card verification (security code)

The first measure is to introduce a card verification service called “security code” at the time of payment.

A security code is a 3-4 digit number written on the back or front of a credit card.

Requiring the entry of a security code in addition to the credit card number increases the effectiveness of preventing unauthorized use.

However, as there are not only advantages but also disadvantages as listed below, it is important not to rely solely on security codes, but to use them in combination with 3D Secure 2.0, etc., which will be introduced next.

| Benefits of security codes | Unlike passwords, users won’t forget it. |

| Disadvantages of security codes | If stolen or lost, there is a risk of information leakage along with the credit card number. |

The article below explains the role of security codes and how to prevent their leakage, so please refer to it.

[Countermeasure 2] Introduce EMV 3D Secure (3D Secure 2.0)

The second is to implement EMV 3D Secure (3D Secure 2.0), which is known as a global standard for identity verification services.

3D Secure is a service that prevents fraudulent use by authenticating the user when they make a card payment.

Previously, many businesses introduced 3D Secure 1.0, but it was fully migrated to EMV 3D Secure (3D Secure 2.0) in October 2022, and the introduction of EMV 3D Secure (3D Secure 2.0) is scheduled to become mandatory at the end of March 2025.

If a business has implemented EMV 3D Secure (3D Secure 2.0), the card company will bear the cost if fraudulent use occurs.

[Countermeasure 3] Implement a fraud detection system

Another measure is to implement a fraud detection system.

Similar to credit card number leaks, it may not be possible to completely prevent unauthorized access.

In such cases, one option is to implement a fraud detection system that can consistently take measures against everything from unauthorized access to fraudulent orders.

For example, “O-PLUX,” a fraud detection system developed and provided by Cacco Inc., which operates this site, is a cloud service that can detect fraudulent logins and orders on e-commerce sites in real-time and prevent fraud damage such as personal information leaks, unauthorized credit card use, and malicious resales.

Moreover, “O-PLUX” does not transition to a different screen during order screening, allowing users to place orders with the usual interface, so there is no need to worry about compromising usability.

If you want to prevent chargebacks due to fraudulent orders, why not consider introducing “O-PLUX”?

A trial is also available, so please feel free to contact us.

For inquiries about the O-PLUX trial, please contact us here.

[Countermeasure 4] Purchase chargeback insurance.

The fourth measure is to subscribe to chargeback insurance.

Chargeback insurance is a service that provides a certain amount of compensation if a chargeback occurs.

By subscribing to chargeback insurance, you can receive compensation and reduce losses even if a chargeback occurs.

Businesses that handle high-risk products should consider subscribing to chargeback insurance.

However, be aware that relying too heavily on chargeback insurance may, in the worst case, lead to card companies requesting contract changes or transaction suspensions.

The effectiveness of chargeback insurance as a fraud prevention measure is explained in detail in the following article.

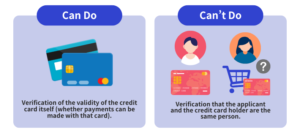

[Supplemental Information] Authorization does not prevent chargebacks

Even with authorization (credit check), chargebacks can still occur.

The reason is that while authorization confirms the validity of the credit card itself, it cannot verify if the applicant matches the credit card holder.

In other words, even if an malicious actor fraudulently uses a credit card, the authorization process cannot detect that the malicious actor is using the card.

As a result, even if authorization goes through (meaning the credit card itself is found to be valid), chargebacks due to fraudulent use can still occur.

Q&A about Chargebacks [For Businesses]

Here are some FAQs for businesses regarding chargebacks.

We have provided detailed explanations for common questions, so please take a look.

What is the Chargeback Process?

When a cardholder requests a chargeback, the refund process generally follows these steps:

- The cardholder disputes the charge with the credit card company.

- The credit card company reviews and investigates the transaction details.

- The card company notifies the e-commerce business of the sales cancellation.

- The e-commerce business refunds the payment to the card company.

- The cardholder is notified of the refund method, and the refund is issued.

The application deadline for a chargeback is approximately 120 days from the transaction date.

The following article is for users, but it explains in detail how to apply for a chargeback, so please take a look.

Are there products and services that are prone to chargebacks?

To conclude, some products are more susceptible to chargebacks.

Based on the performance of companies using our product “O-PLUX,” the ranking of products most targeted for credit card fraud, as determined by a 2023 survey, is as follows:

- Digital content

- Hobbies, games

- Tickets

- Cosmetics and hair care

- Health foods and apparel

As the ranking shows, items with high unit prices and convertibility are ranked higher.

Apparel, which is often sold on flea market sites, is also a product category prone to chargebacks.

The reason why easily resalable products are prone to chargebacks is that they are often targeted for fraudulent use, for purposes such as converting them into cash.

From a company’s perspective, when large orders are placed for such products, careful judgment is required to determine if they are intended for resale.

Can chargebacks be prevented?

If the reason for the chargeback is malicious, EC businesses can file an objection (chargeback rebuttal) with the credit card company.

However, whether the rebuttal (rejection) will be accepted is at the discretion of the card company, and it is not guaranteed to be successful.

Points to note when refuting a chargeback include:

- You only have one opportunity to refute a chargeback.

- You must provide documentary evidence.

- If you do not reply by the specified deadline, refutation will not be possible.

- Fraudulent orders carry the risk of forced chargebacks.

Additionally, since refuting chargebacks is a time consuming process, it would be advisable to implement measures to prevent chargebacks from occurring in the first place.

Please refer to the article below for a detailed explanation of chargeback refutation.

Summary: Businesses should take measures against fraudulent use before chargebacks occur

Finally, businesses should implement measures to prevent fraudulent use before chargebacks occur.

It may be difficult to determine how much to invest before any damage occurs.

However, for issues with significant post-occurrence burdens like chargebacks, preventing them proactively can support business management.

“O-PLUX” from Cacco Inc., which operates this site, has been introduced by companies handling apparel, home appliances, cosmetics, and more as a chargeback countermeasure.